UK-based customers of the Berlin-based company were told today their accounts would close by April 15th, Reuters reports. N26 opened shop in the UK just five months ago, some two years after the public voted to leave the European Union in the first place. In fact, its CEO Valentin Stalf told CNBC in October that launching in the UK was “a no-brainer for us, independent of Brexit.” N26 hosts approximately 200,000 British accounts, whose owners are likely to be pushed towards digital banking alternatives like Monzo and Revolut.

N26 not even in top 10 ‘challenger banks’ in the UK

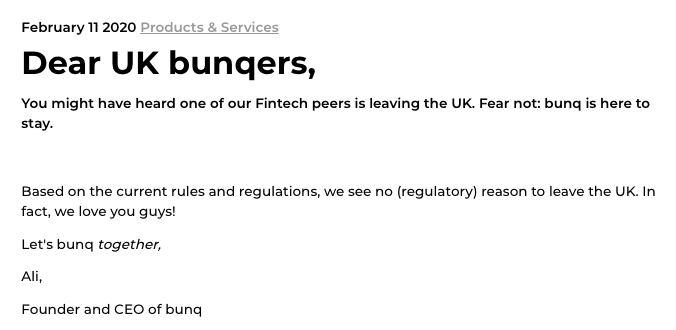

It didn’t take long for rivals to poke fun at N26. Dutch startup Bunq posted a blog offering its skepticism over whether regulatory concerns truly motivated N26’s sudden post-Brexit bailing. Certainly, N26 is successful in other markets. It reportedly boasts 4.5 million users globally, but it never really found a solid foothold in the oversaturated British market. Indeed, data published by Sifted in December revealed N26 ranked 19th in the list of top British fintechs, sorted by monthly active users. Cryptocurrency exchange Coinbase had more users. As for Revolut and Monzo, they already service more than 1 British million customers, as does Starling Bank. So, instead of continuing to struggle to poach users, N26 is expected to focus on growing its presence in the US market. The Peter-Thiel backed startup has serviced customers across the US since mid-2019. Last month, N26 claimed it had attracted 250,000 American users, including some who’d moved over from big names like Chase and Citibank — but it need loads more if it’s going to thrive there, too.